What types of savings are typical?

In a word, no savings are typical due to the ever complexities of utility invoices. In deregulated markets, tariffs and pass through charges (i.e., non-commodity costs) make up anywhere between 50 and 60 percent of your energy bill.

Managing these costs is difficult. Due to the variety of different tariffs available. On both tariff and non-commodity charges are constantly changing. There is no legal requirement for a utility supplier to offer you the most cost-effective rate option. Or to inform you that a supply is eligible for an exemption for all, or part, of certain non-commodity charges.

CEP’s Analysis and Optimization services ensure businesses are not overpaying for their energy requirements. As part of this service, experienced bureau analysts assess all applicable rate options offered by the local utility supplier. More cost-effective options are identified. These are then ranked (by savings and suitability).

Next with your approval, implemented. In addition, all non-commodity charges are reviewed to identify opportunities to reduce or eliminate these additional costs. Our Analysis and Optimization service provides businesses with quantifiable and long-term energy cost savings. This is part of our standard customer service level agreement.

Invoice data checking carried out by CEP

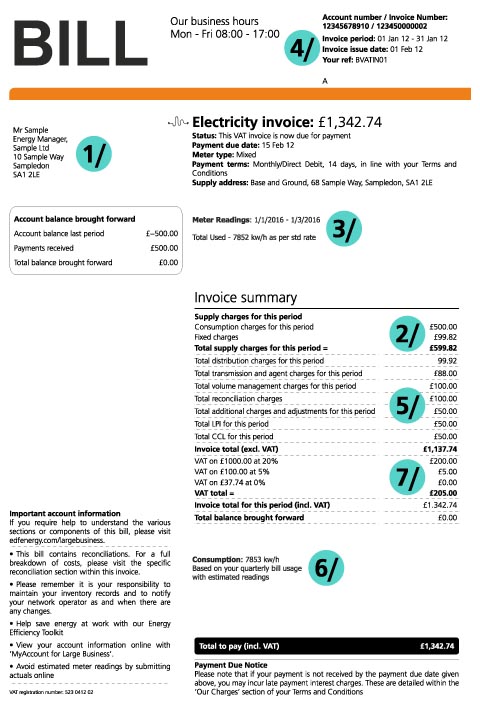

- 1/ Invoice sent to client who no longer occupies the property

Especially multi-site clients have failed to

notify the suppliers when vacating a premise. - 2/ Incorrect contract rates applied

The rates in which the client is contracted

to doesn’t match with the invoice. - 3/Meter readings

Meter readings do not match the previous invoice.

Issues with meter or incorrect multiple/factor used. - 4/ Overlapping invoicing period

The number of billing days invoiced in previous

months overlap. - 5/ MD Demand inconsistencies The KVA demand is incorrect with the site profile.

- 6/ Consumption inaccuraciescurrent invoice shows a spike or drop in consumption

which isn’t historical with the supply. - 7/ Incorrect Tax Relevant VAT premium is applied – Previous balance

and late fees. Incorrect balance carry

forward or late fees.